That's right, shopping centers.

To this end, in 1982 lawmakers passed a nifty little statute giving huge retail meccas a hefty property tax break, if only they'd commit to commerce within our humble borders.

Fast forward to 2001, and that tax-code dinosaur is still on the books. Meanwhile, mom-and-pop business folk who don't tend shop alongside a Home Depot or Fry's, or inside gleaming Tucson Mall, still bear the brunt of this discriminatory tax arrangement.

Here's how it works: If a retail shopping center meets certain criteria, such as being at least 27,000 square feet in size, and boasting a box store of at least 10,000 square feet that's either owner-occupied or under long-term lease, local governments can only tax that property under what's called the "replacement cost less depreciation method."

In plain English, qualifying shopping centers can only be taxed on the bricks-and-mortar value of the property itself, minus depreciation. So if a center was worth a couple million when it was built, and loses value as it ages, its property taxes decrease as well. This occurs even if the property's true market value steadily climbs, as many in Tucson do.

Still, shopping center owners can submit their property income for real estate tax evaluation as well--an option generally exercised only by the occasional financial nitwit or dyslexic accountant. Obviously, few of this class boast the wherewithal to own large retail hubs.

Now contrast that with property tax formulas in place for all other retail outlets, such as smallish strip malls lacking an anchor store. Their property taxes follow a normal three-pronged approach, based on the property value minus depreciation--like their boxy brethren--but also on the actual market value of their property, and the income that property generates.

In real numbers, this can mean dramatic differences.

Ruben Reyes, senior appraiser for the Pima County Assessor's Office, explains: "Going by the 1982 statute, we must value the shopping center property out the door, using only the replacement-cost-less-depreciation approach as valuation," he says.

"Being restricted to this approach doesn't let us address the economics. The statute doesn't let us use market as approach to value [for shopping centers] unless an owner submits income. If retail sales on that property are higher than its value, he's not gonna submit it."

Reyes recalls a retail strip on Oracle Road that sold in 1998 for $1.85 million. Not long after, a big box store was added to the strip. "Then it qualified as shopping center," he says, "and its tax valuation dropped by about 50 percent."

Meanwhile, the true market value of that property remained the same, or perhaps even grew. "Investors don't care what value we have on it," he says. "They're going to look at rents, leases, what tenants are paying and expenses. They want to see cash flow, net operating income."

This inequality comes as news to most landlords not basking in the shade of a big box store--which includes about 400 retail strips in Pima County--and who don't receive similar tax breaks. "It's true, a lot of them just aren't aware of the statute," Reyes says. "And as an appraiser, my hands are tied. That's statute I have to follow."

LOREN ACKER OWNS A retail complex on the corner of Tucson Boulevard and Sixth Street, wherein dwells the Rincon Market, Bob Dobb's Bar and Grill and a few other small businesses. He's never heard of this enduring statute. But on its face, he thinks it unfair, since his own property taxes rise unabated, as the market value of his property grows.

"The neighborhood stores already have a hard time of it," he says. "So on the surface, I would have a hard time understanding this law."

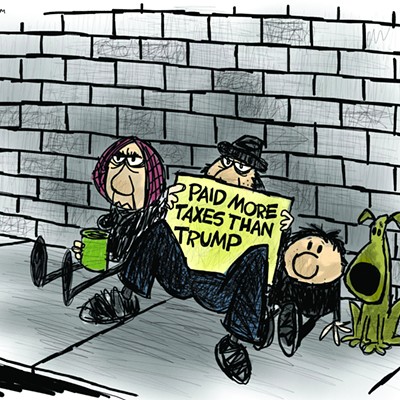

Others, such as State Representative Steve May, understand these sweetheart tax breaks only too well. "They're so bogus," says the lawmaker, who chairs the House Ways and Means Committee, and sits on the Commerce and Economic Development Committee. "I generally oppose all [specialized tax preferences] because if you give preference to one group, you hurt their competitors.

"The whole way we give tax preferences to the big dogs, to the special-interest lobbyists in Arizona, is completely inappropriate. The Arizona tax code is like Swiss cheese with special-interest tax breaks. And this is why tax rates in Arizona are so high--because certain taxpayers don't pay any taxes, effectively, so the other taxpayers have to pay more.

"Instead of fixing the problem of high rates, the [tax code] leaves certain taxpayers out of the system," he says. "I hope small-business people concerned about this give me a call."

But among those who won't be calling soon are shopping center moguls benefiting from the tax break. Repeated attempts to obtain comment from officials of Tucson area malls were unsuccessful.

However, the Tucson Weekly did reach Michelle Ahlmer, executive director of the Arizona Retailers Association. She thinks the special tax status is just hunky-dory. "I guess I'm a little surprised there would be any complaints about this," Ahlmer says. "The reason [the statute] is there is because, as economic times change--and we're right in the middle of one that's a perfect example--we don't want to put these shopping centers out of business just based on their tax valuation.

"It is an advantage for them, but it's not an advantage that can really mess up other property owners. The reason retailers were supportive of it is because it's a direct pass-through to the tenants of the shopping centers. There are a lot of small retailers in shopping centers, especially those little kiosks, that would be hit really hard if that [tax] valuation were to change."

Which raises the question: What about small retailers who go head-to-head against tax-enhanced shopping centers?

In this case, Barb's Frame of Mind comes to mind. The charming frame shop just off Fourth Avenue doesn't benefit from any such tax breaks, because its landlord doesn't get any. Meanwhile, Barb's faces competition from a similar store in El Con Mall that receives the "direct pass-through" Ahlmer describes.

Shop owner Barb Robinson calls this a raw deal for folks like her. "This doesn't sound fair to me at all. I don't think they should be getting such a deal, when the rest of us out here don't. It's just not right."